A four-way battle for bedding supremacy is brewing in the highly competitive mattress arena.

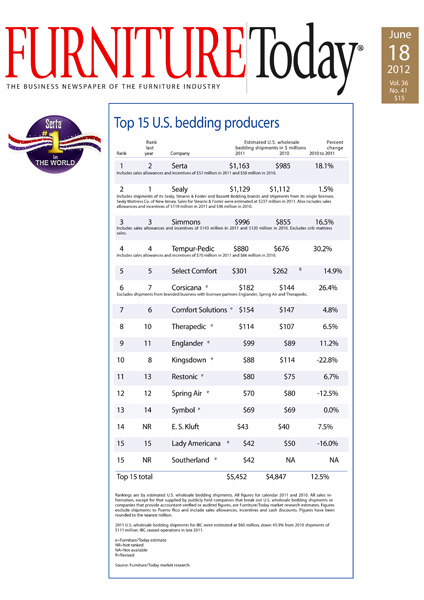

As reported last month, Serta® has unseated longtime do-mestic champ Sealy and now ranks as the largest U.S. bedding producer. Serta® earned that top spot on the heels of an 18.1% shipments gain last year, far ahead of Sealy’s lackluster 1.5% growth rate that year. Sealy is No. 2 after decades as the unquestioned sales leader.

And Sealy now finds itself pressed by three fast-growing producers. No. 3 Simmons managed to compile almost as strong a year last year as Serta®. Simmons boosted its shipments by 16.5% and fin-ished the year with U.S. ship-ments of $996 million — just $133 million behind Sealy.

And No. 4 Tempur-Pedic posted the strongest growth of any Top 15 bedding pro-ducer last year, boosting its shipments by 30.2%, to $880 million.

Those are some of the highlights of Furniture/To-day’s ranking of the Top 15 U.S. Bedding Producers, an exclusive look at the perfor-mance of bedding’s top man-ufacturers.

In addition to the change at the top of the rankings, this year’s list is notable be-cause it marks the entry of two new players to bedding’s pantheon of elite players. E.S. Kluft & Co., headed by luxury bedding aficionado Earl Kluft, enters the rank-ings for the first time ever, in the No. 14 position. And in-dependent bedding producer Southerland also cracks the list for the first time, tying with Lady Americana at the No. 15 position.

Also notable is the depar-ture of International Bedding Corp., a Top 10 producer that ceased operations late last year. Furniture/Today esti-mates that that company, whose assets were acquired by Corsicana’s Sleep Inc. unit, generated shipments of $60 million last year.

Bedding’s top five produc-ers — Serta®, Sealy, Simmons, Tempur-Pedic and Select Comfort — are either pub-licly held or supplied audited or accountant-verified fig-ures to Furniture/Today. One other company — E.S. Kluft & Co. — supplied accountant-verified figures to the news-paper.

Figures for the rest of the companies on the list — Corsicana, Comfort Solu-tions, Therapedic, Englander, Kingsdown, Restonic, Spring Air, Symbol, Lady Americana and Southerland — were de-veloped by a Furniture/Today survey of producers, analysts and suppliers. All of those companies are privately held and did not provide audited or accountant-verified fig-ures.

The Top 15 list shows an-other strong year for Tempur-Pedic and Select Comfort, the two specialty sleep producers that continue to stand out with aggressive advertising and marketing programs. As noted, Tempur-Pedic led the entire Top 15 field with its 30.2% shipments growth, while Select Comfort did well with its 14.9% growth in ship-ments.

Another standout is No. 6 Corsicana, the promotional bedding powerhouse based in Corsicana, Texas. It saw its shipments jump 26.4% last year, to $182 million. (That figure does not include the Therapedic, Englander or Spring Air branded business that Corsicana’s Sleep Inc. unit generates.) Overall, the Top 15 bed-ding producers grew by 12.5% last year, well above the over-all industry growth figure of 7.7% reported by the Interna-tional Sleep Products Assn. No. 7 Comfort Solutions, displaced in the No. 6 spot by Corsicana, had a 4.8% gain in shipments last year, with total shipments of $154 mil-lion, according to Furniture/Today’s survey of producers, analysts and suppliers. No. 8 Therapedic, which moved up two spots from the previous year, saw its ship-ments grow by 6.5%, to $114 million, according to the Fur-niture/Today survey. No. 9 Englander joined the Top 10 list on the strength of an 11.2% gain in shipments, to $99 million.

Falling two places was No. 10 Kingsdown, which saw its shipments drop 22.8% to $88 million. That was the biggest shipment decline of any top 15 producer. No. 11 Restonic moved up two spots as its shipments rose 6.7%, to $80 million, while No. 12 Spring Air kept its position in the rankings but saw its shipments drop 12.5% to $70 million, accord-ing to the Furniture/Today survey of producers, analysts and suppliers. No. 13 Symbol was flat with shipments of $69 mil-lion, while Lady Americana saw its shipments drop an es-timated 16%, to $42 million. E.S. Kluft’s accountant-verified figures showed that producer posted 7.5% growth in shipments last year, to $43 million. That figure does not include bedding distributed under the Comfort Solutions banner; Kluft is a licensee of that producer.